how much child benefit and child tax credit will i get

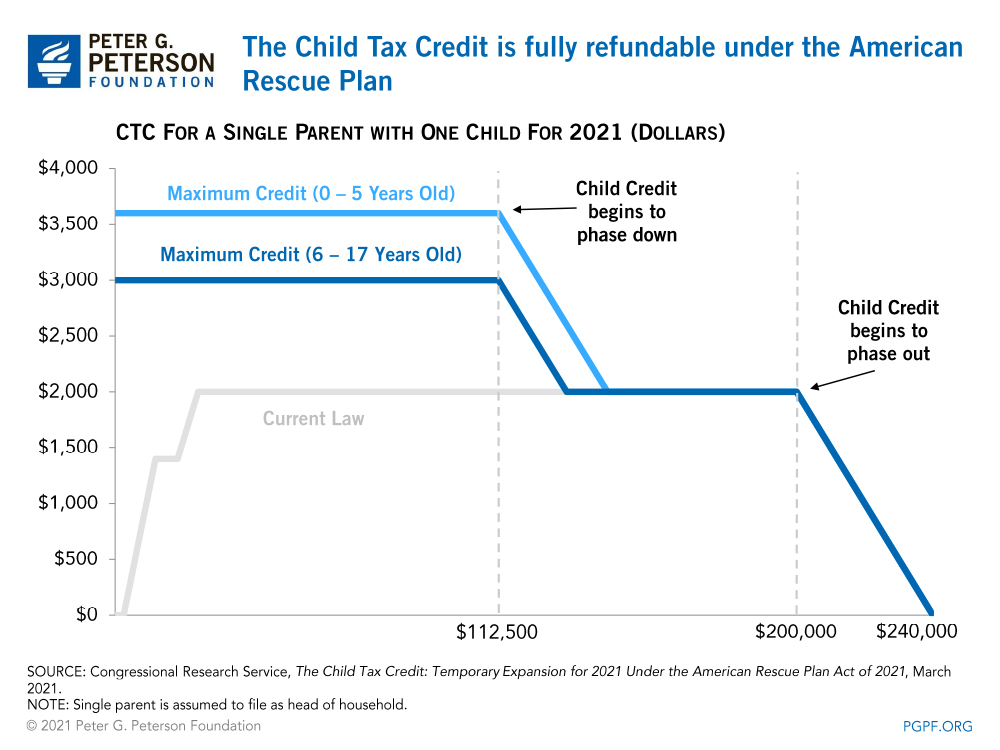

Since the maximum benefit for a child under 6 is 6997 annually you subtract the total reduction from that number and then break it into months. From July to December of 2021 eligible families received an advance child tax credit up to 300 per child under six years old and 250 for children between the ages of six to 17.

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

To qualify for the maximum amount of 2000 in 2018 a single.

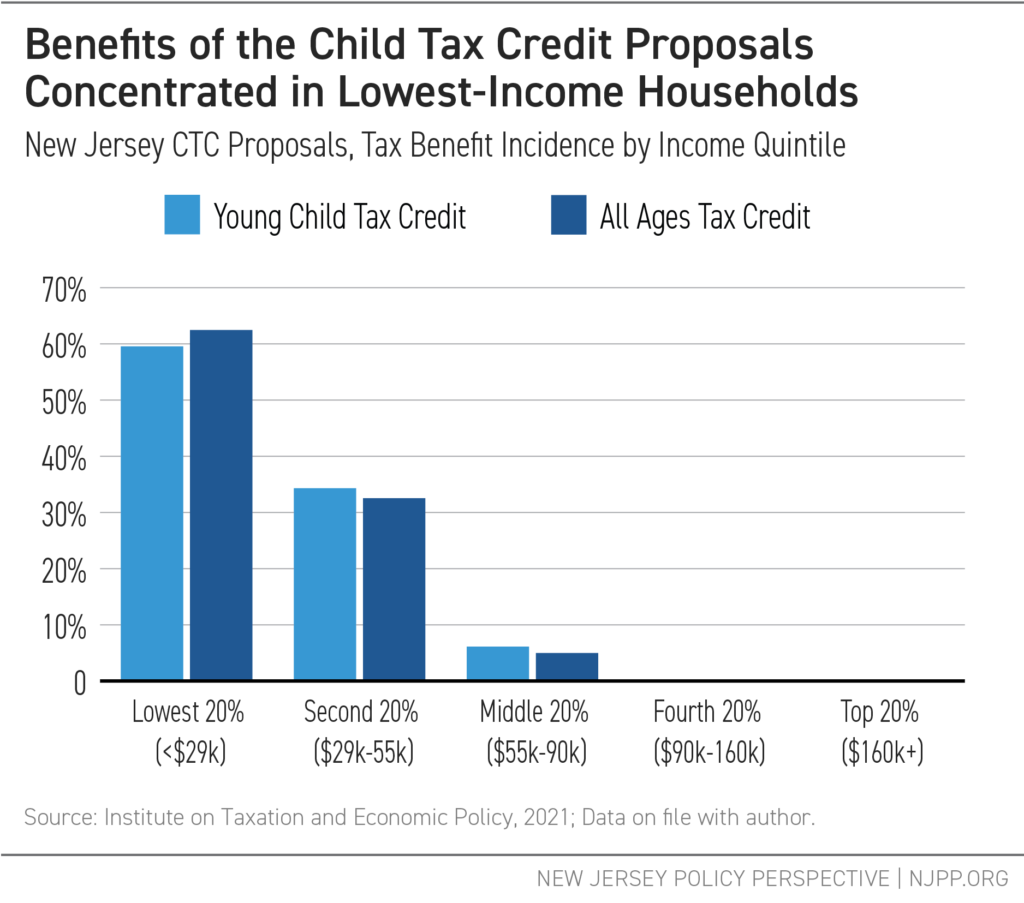

. Who the allowance is for. The taxpayers earned income and their adjusted gross income AGI. The Child Tax Credit will help all families succeed.

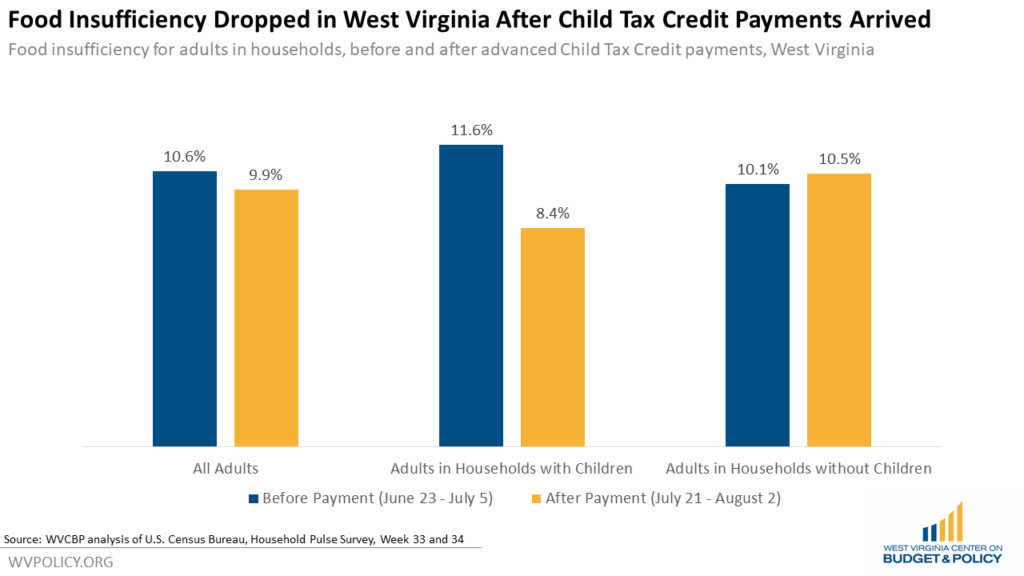

Millions of families across the US will be receiving their third. Already claiming Child Tax Credit. The Child Tax Credit provides money to support American families.

The amount you can get depends on how many children youve got and whether youre. Child benefit is not means tested - and is paid to those responsible for children with a weekly payment to cover each and every child in your household. Making a new claim for Child Tax Credit.

The American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per child for children over the age of six and from. Two Factors limit the Child Tax Credit. A childs age determines the amount.

It will not be reduced. Child Tax Credit is applicable to families with children younger than or of 17 years of age. Taxpayers can get up to 3000 for the 2022 tax year if theyve got an unborn child with a detectable heartbeat between July 20 and Dec.

If youre responsible for any children or young people born before 6 April 2017 you can get up to 3480 a year in child tax credits for your first child and up to 2935 a year for each of. Rate weekly Eldest or only child. 6 min read.

There are 2 Child Benefit rates. 6997 per year 58308 per month 6 to 17 years of age. Have been a US.

If your AFNI is under 32797 you get the maximum amount for each child. 6997 85421 614279year or 51190month. At what age does Child Tax Credit stop.

Families could be eligible to. Here is some important information to understand about this years Child Tax Credit. You must contact the Child Benefit Office if you.

This means theyd receive 51190 per month assuming the child was under 6. Youll only get the second cost of living payment once - even if you get. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors.

For 2021 eligible parents or guardians can. Total child tax credit payments between 2021 and 2022 could be up to 3600 per kid. To get this payment you must get child tax credits covering any time between 26 August 2022 and 25 September 2022.

Child Benefit for young people aged 16 or over. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. Once a child turns 18 and becomes an adult payments with regard to Child Tax Credit are automatically stopped by the DWP.

Under 6 years of age. You get 2180 per week for your first child and 1445 for each and every one of your other children.

How Many Child Tax Credit Payments Remain For 2021 As Usa

Data Already Showing Positive Impacts Of Child Tax Credit Though More Can Be Done To Ensure Benefit Reaches All Children West Virginia Center On Budget Policy

The 2021 Child Tax Credit Information About Payments Eligibility

The Child Tax Credit The White House

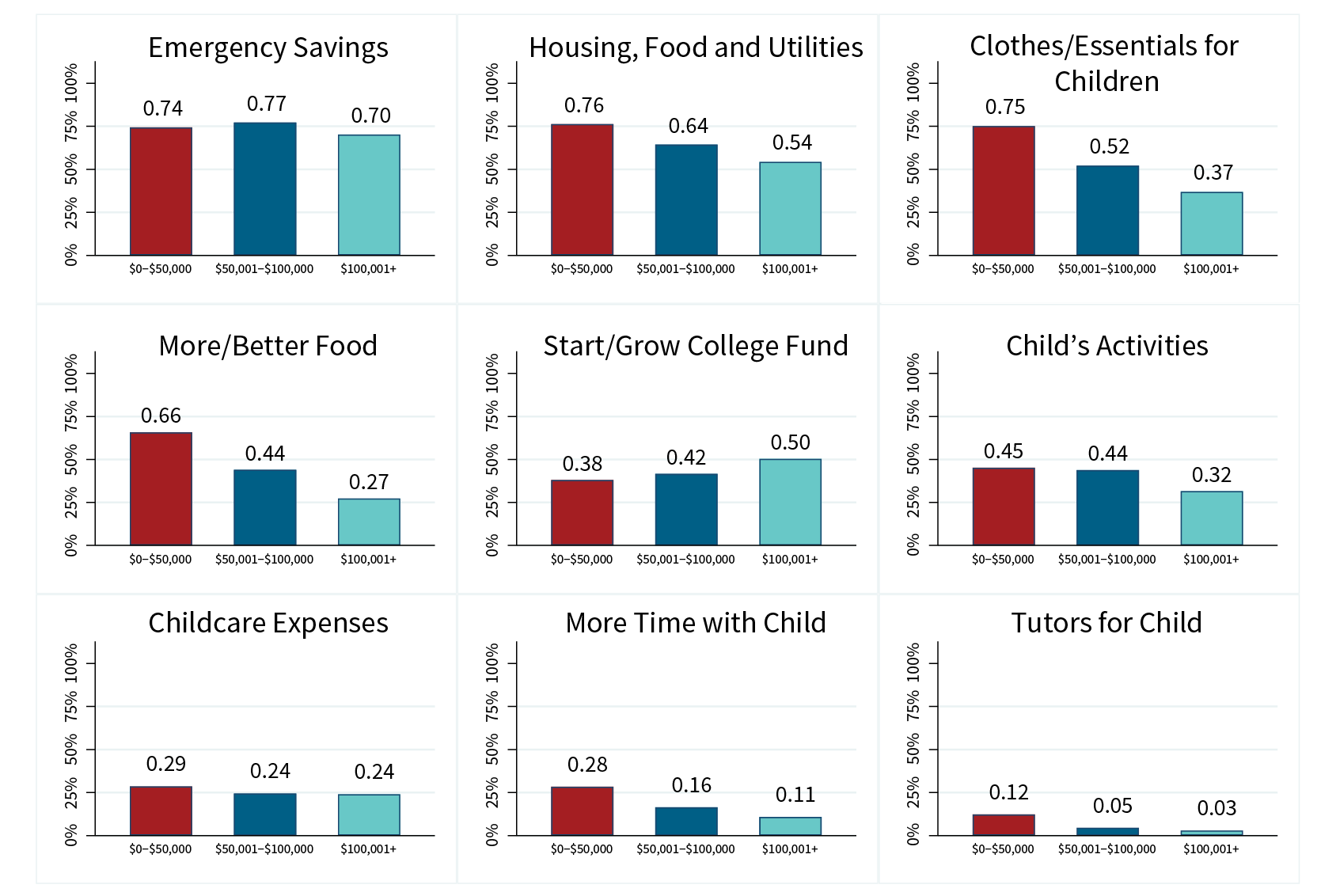

Child Tax Credit 2021 Here S How Families Say They Ll Use Basic Income For Kids Cbs News

What Is The Child Tax Credit Tax Policy Center

/cdn.vox-cdn.com/uploads/chorus_asset/file/8399887/ChildAllowance_report.png)

Child Poverty In The Us Is A Disgrace Experts Are Embracing This Simple Plan To Cut It Vox

White House Promotes Use Of Tax Credits For Parents And Employer Paid Leave

What Is Child Tax Credit Low Incomes Tax Reform Group

How Can Children Benefit From The Us Child Tax Credit In The Future Humanium

The Progressive Case For A Unified Child Benefit Center For Economic And Policy Research

Making New Jersey Affordable For Families The Case For A State Level Child Tax Credit New Jersey Policy Perspective

Now Is The Time For An American Child Benefit People S Policy Project

Child Tax Credit Irs Portal Might Not Reach Those Who Need It Most

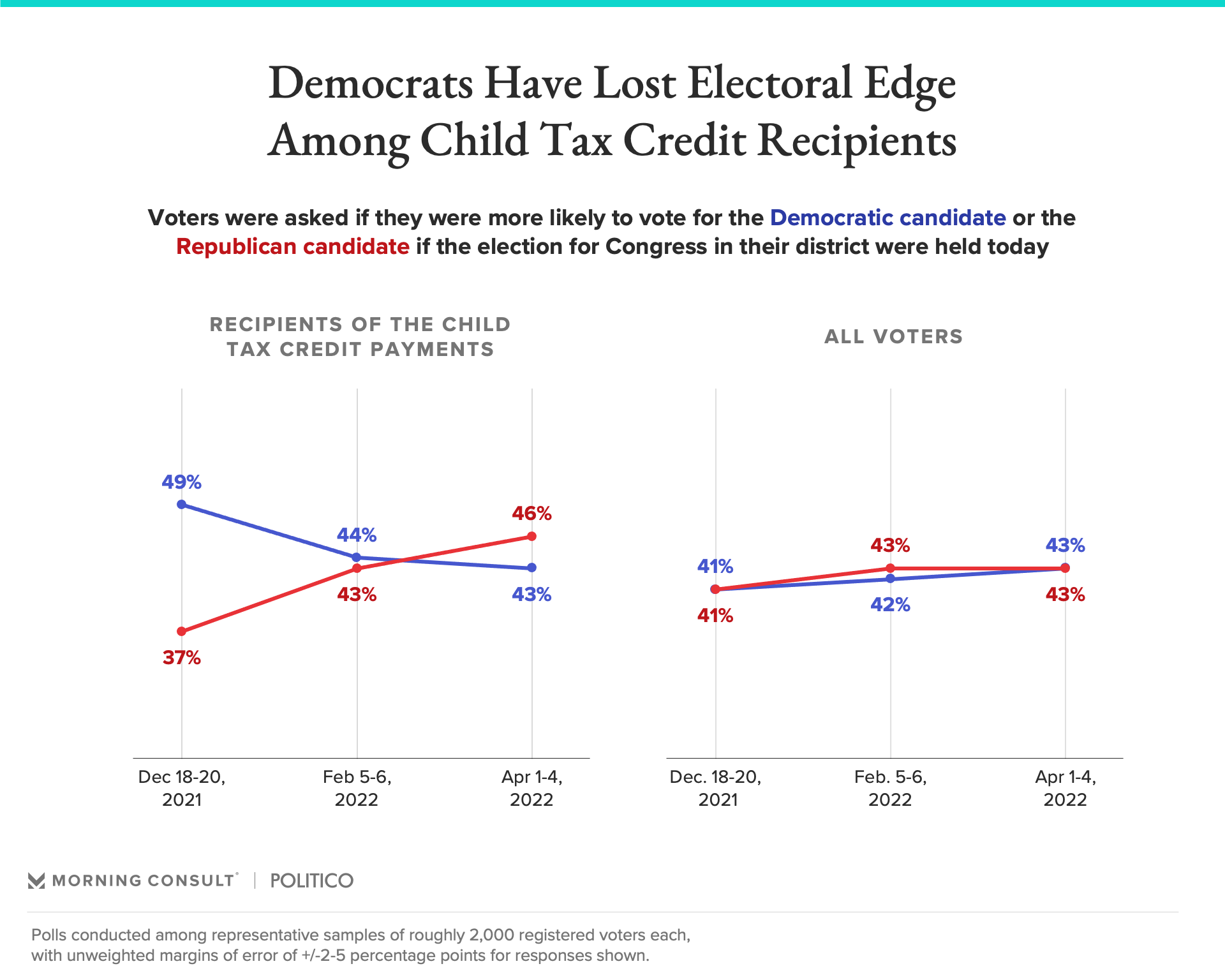

Republicans Favored To Win Senate Among Child Tax Credit Recipients

The New Child Tax Credit Does More Than Just Cut Poverty

Child Tax Credit And Earned Income Tax Credit Disability Law Colorado

Now Is The Time For An American Child Benefit People S Policy Project